2018年5月31日 星期四

小子摸擬退休倉

早排小子講開唔想貼咁多股票出來俾人跟, 諗深一層,其實6088 個D係短炒,貼出來你死跟多數都係PK 居多, 出得文來可能我都沽左, 跟車太貼又跟唔到, 出事可以預期

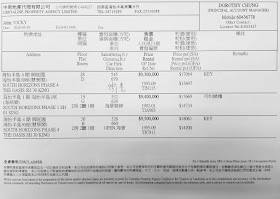

咁小子一向都有整開個摸擬退休倉 (利申, 未開始買), 仲係優化STAGE, 因為係想正式離開呢間公司, 同埋KICK START 左先貼出來, 小子大約會拎USD 2M (HKD 16M) 出來做呢個盤, 姑且貼出來, 拋磚引玉, 等大家研究下, 不過利申, 未買同埋未CONCLUDE 哂D成員

利申, 不構成投資建議, 買賣要約, 小子亦都唔會亦無責任解答任何基本及技術面的問題, 敬請垂注

2018年5月30日 星期三

反價潮啟動, 投行講樓市

小子最近又開始收到電話問間屋放唔放,租唔租等等。一葉知秋,應該市場好缺盤下,問下經紀,不問由自何,一問直頭嚇親,呢家啲業主叫價心雄到咁!

今朝又收到親愛的JPM 講樓市 (廢話一篇)

HK property - catching the falling knife?

Dear all,

A topic which is closed to our heart

· View on property price given stronger property supply in the market

o Property price will go up 15% this year, so far it’s 10% and is expected to surpass target

· Worries about rising interest rates, which will impact mortgage rate and property price

o It should be noted that it’s not the nominal interest rate but the real interest rate that drives the property price

o Even though we expect HK inflation to increase by 100bps following US, HK real interest rate is still negative.

o 1/3 of the inflation in Hong Kong is driven by housing rental, which usually leads the CPI by 12 months; last year we saw housing rental increased by 10%, which will further drive inflation this year.

o There is long-term high negative correlation between real interest rate and Hong Kong property price (I really wanna laugh >.< '', 地產界有一句好中, 有分析, 無出色)

· Income unaffordability supported by more aggressive financing

o About 30% of the property sales is supported by refinancing;

o Leverage ratio is currently safe in Hong Kong property market, with only 13% total leverage

o The highest LTV was in 2003 with ~30%. LTV is more of a function of property value, where the LTV boosts up when property price drops.

· Land Supply situation in Hong Kong

o The most likely option to be supported by public and implemented by the government to solve the limited land supply situation will be farm land conversion

o The potential solution supports our previous positive view on Henderson Land, which has converted several farm land already

o One of the land supply solutions is to remove the entire terminal away from Kwai Chung. (wait until 2099 la on99)

o Estimated impact on NAV if the terminals were converted to residential use will be HK$16.6Bn for Modern Terminals and HK$13.9Bn for HIT Terminals in terms of Present Value, which represent 21% and 40% of the current market cap respectively; although it is expected to take place in 20 years’ time.

· Recent Land Acquisition strategy by aggressive local developer

o From Developers’ points of view they have been conservative over the last few years. (and also for most of the property owners in the market la DLLM)

o The recent high P&L and margin over the last two years incentivize developers to be more aggressive.

· Investment opportunity discussion - Sino land & Henderson Land & CK Asset

o Sino land hasn’t been a high profile developer previously as for the last four years. However, the company will launch 4 different projects from summer 2018 to Q1 2019, with gross sales of US$48Bn and US$42Bn net cash inflow. On top of the current net cash, there will be

US$ 63bn net cash in 12-month time, which represents 74% of its current market cap.

o Dividend hike is expected from increasing net cash flow; on average Sino has ~40% margin from the projects; the company has a track record of increasing dividends when disclosing projects.

o Henderson Land is expected to benefit from farm land conversion.

o CK Assets – Center transaction is a done deal and S&P signed; Share buyback from the company is not expected and this signals the probability that the company is waiting for a large investment where the cash will be used.

· Retail segment

o Strong retail sales with shopping malls reporting 20% ~30% YoY retail sales growth; While people usually believe that retail sales drives up retails rent, this is not going to be the case anymore.

o Rental income used to be very sensitive to rental sales back in 2012; However when retail market is on the down trend, a lot of retail landlord asked for a much higher proportion of base rent and smaller proportion of rent turnover rate when renewing the lease with tenants, trying to put themselves in a more defensive position. Since then the rental income has been less sensitive to retails sales during upsides and there has been disconnection between retail sales and rental income.

o Occupancy costs for mall operators are still stretched

o Investing directly in retail segment won’t be actively advised.

· Link REIT

o Link REIT’s share price has grown over 10 times since its listing with low volatility

o Even if the shopping mall is only reporting 6-7% retail sales growth, rental sales growth as well as reversion remain strong.

o Link REIT’s management has realized that they cannot always rely on organic retail growth in HK so they are heavily engaged in share buyback and actively look for opportunity for new investments in China shopping malls from which they generated decent revenue.

不過無他,太古城舊到爆全樓景,仲要唔係近地鐵都做緊1200萬起跳,海怡就算950兩房,個則無咁好,但係環境好啲,仲要平30%,實在唔係非常過份(更加唔好比西區泓X個垃圾則近啲不受歡迎設施,2房1100-1200萬)

今朝又收到親愛的JPM 講樓市 (廢話一篇)

HK property - catching the falling knife?

Dear all,

A topic which is closed to our heart

· View on property price given stronger property supply in the market

o Property price will go up 15% this year, so far it’s 10% and is expected to surpass target

· Worries about rising interest rates, which will impact mortgage rate and property price

o It should be noted that it’s not the nominal interest rate but the real interest rate that drives the property price

o Even though we expect HK inflation to increase by 100bps following US, HK real interest rate is still negative.

o 1/3 of the inflation in Hong Kong is driven by housing rental, which usually leads the CPI by 12 months; last year we saw housing rental increased by 10%, which will further drive inflation this year.

o There is long-term high negative correlation between real interest rate and Hong Kong property price (I really wanna laugh >.< '', 地產界有一句好中, 有分析, 無出色)

· Income unaffordability supported by more aggressive financing

o About 30% of the property sales is supported by refinancing;

o Leverage ratio is currently safe in Hong Kong property market, with only 13% total leverage

o The highest LTV was in 2003 with ~30%. LTV is more of a function of property value, where the LTV boosts up when property price drops.

· Land Supply situation in Hong Kong

o The most likely option to be supported by public and implemented by the government to solve the limited land supply situation will be farm land conversion

o The potential solution supports our previous positive view on Henderson Land, which has converted several farm land already

o One of the land supply solutions is to remove the entire terminal away from Kwai Chung. (wait until 2099 la on99)

o Estimated impact on NAV if the terminals were converted to residential use will be HK$16.6Bn for Modern Terminals and HK$13.9Bn for HIT Terminals in terms of Present Value, which represent 21% and 40% of the current market cap respectively; although it is expected to take place in 20 years’ time.

· Recent Land Acquisition strategy by aggressive local developer

o From Developers’ points of view they have been conservative over the last few years. (and also for most of the property owners in the market la DLLM)

o The recent high P&L and margin over the last two years incentivize developers to be more aggressive.

· Investment opportunity discussion - Sino land & Henderson Land & CK Asset

o Sino land hasn’t been a high profile developer previously as for the last four years. However, the company will launch 4 different projects from summer 2018 to Q1 2019, with gross sales of US$48Bn and US$42Bn net cash inflow. On top of the current net cash, there will be

US$ 63bn net cash in 12-month time, which represents 74% of its current market cap.

o Dividend hike is expected from increasing net cash flow; on average Sino has ~40% margin from the projects; the company has a track record of increasing dividends when disclosing projects.

o Henderson Land is expected to benefit from farm land conversion.

o CK Assets – Center transaction is a done deal and S&P signed; Share buyback from the company is not expected and this signals the probability that the company is waiting for a large investment where the cash will be used.

· Retail segment

o Strong retail sales with shopping malls reporting 20% ~30% YoY retail sales growth; While people usually believe that retail sales drives up retails rent, this is not going to be the case anymore.

o Rental income used to be very sensitive to rental sales back in 2012; However when retail market is on the down trend, a lot of retail landlord asked for a much higher proportion of base rent and smaller proportion of rent turnover rate when renewing the lease with tenants, trying to put themselves in a more defensive position. Since then the rental income has been less sensitive to retails sales during upsides and there has been disconnection between retail sales and rental income.

o Occupancy costs for mall operators are still stretched

o Investing directly in retail segment won’t be actively advised.

· Link REIT

o Link REIT’s share price has grown over 10 times since its listing with low volatility

o Even if the shopping mall is only reporting 6-7% retail sales growth, rental sales growth as well as reversion remain strong.

o Link REIT’s management has realized that they cannot always rely on organic retail growth in HK so they are heavily engaged in share buyback and actively look for opportunity for new investments in China shopping malls from which they generated decent revenue.

2018年5月29日 星期二

靠樓財自的三個階段

小子近排同好朋友翻睇港島區, 事關好友想出手又唔想買錯野, 小子就膽粗粗獻身一齊尋寶

當然還有令小子心痕痕的樓想出手, 但係15%的影響下, 就好似三人行兄講, 連"磚頭導師"都無得靠低買高賣去維生

齋坐貨. 收YIELD 其實距離財自有一點距離

但小子想講, 個班磚頭導師其實真係好L流.....10間? 小子識朋友今年都食左過億貨, 而仲係非常低調地食, 高調個班只係為左搵"學生" 呢個RISK FREE RETURN 而已, 好似R兄話齋, 食面口飯真係......免了

講番正題, 靠樓財自其實有3個階段:

1. 槓桿期

就係一個人的第一間樓, 相信無咩人唔靠槓桿可以FULL PAY 買. 而第一間樓, 絕對係, 多數係 (或者一定係) 靠槓桿, 例如呢家你買一間6M 樓下, 做80% 按揭 (或者4M樓下做90%按揭), 其實係做緊5倍/10倍槓桿

2. 播種期

當然, 成件事要成功, 先係在槓桿期買"啱"野, 可以係201X年開錯價的新樓, 可以係2012年的沙中綫/西環綫, (但唔包IMPERIAL KENNEDY), 又可以係2011-13年的市區單支/ 2014-15年的居屋狂潮...等等

好多人等個價升左之後, 翻按再推多一間, 咁就一生二宅 (又或者2011年前1開N, 不過小子此等80後就無咩可能享受到呢D咁筍的福利)

**其實小子認為一個家庭2間已經係正常人可以到達的極限

但講多幾句, 其實係HKMA 壓測下, 呢樣野已經唔可能, 因為MAX 只可以借一個人的100倍月薪左右, 而當你8皮野人工, 最多借8M 咁計, 基本上, 第二間樓已係不可能 (除非你老婆買, 咁叫做一人一間, 唔係一生二宅)

同埋播種期係好多人KICK住的時間, 因為一個人一生都好大機會買/賣唔到10間以上的物業, 所以買錯野 (例如泰國樓)的機會係大增, 如果你買左日本泰國樓明賺暗蝕輸滙水, 或者買左英國LONDON 跌左20%, 直接係對自己的財自路係會造成毁滅性的打擊 (或者買左D超高溢價的新樓/半新樓亦如是)

呢個STAGE亦都係大部份人停滯不前的時間;

財自, 除左要買啱野, 仲要買啱注碼

3. 收割期

王杰都有話, 我要知道幾時要退, 持盈保泰乃係重中之重, 死買爛買無限推, 一個浪打埋來便好似某D過氣大炒家咁, 2012/13年已話唔合理, 唔會高追, 結果進退失遽; 如果你係7老8十無所謂, 如果你係30幾, 就一生投資之路好似利記門將咁, 極大陰影面積下前行就無謂

因為DSD 同埋壓測關係, 基本上做到第二間已經收皮 (當然有知識有膽色係可以做到3,4,5,6間), 淨番下來就係減債, 而呢個可以有兩種形式

3a) 消極式

用人工及租金減債, 直到租金收入大於供樓支出

3b)主動式

係換貨為主, 將低YIELD的PORTFOLIO換成比較高YIELD的貨, 但係會GIVE UP 左升值潛力 (或者唔會,睇個人的操盤技術), 去蕪存菁, 搞掂後租金收入>供樓支出

# 當然, 一個叻人係唔會死買爛買, 一定係有幾台搵錢機器, 例如股/債/REITS/生意/主動收入等等去幫手加速減債, 但係單靠換貨得宜, 正常來講, 做到租金>供樓其實唔係一件遙不可及的事

不過相比起純債/REITS/ 股來講, 收入一定係有所不及, 因為債唔會升, REITS 理論上無樓升得咁多, GIVE UP 左個升值, 去買番個YIELD, 係合理TRADE OFF

今日柏蔚山開價, 小子係好痕好痕好L痕....一來, LEVERAGE RATIO 已係減到40% 樓下, 二來, 新世界呢幾年新作係有D質素, 小子係想整番間, 無奈2房15M (我估), 如果佢貼15% DSD 我可能會落疊, 不過呢口價真係...幾辣

姑且睇下佢開咩價

當然還有令小子心痕痕的樓想出手, 但係15%的影響下, 就好似三人行兄講, 連"磚頭導師"都無得靠低買高賣去維生

齋坐貨. 收YIELD 其實距離財自有一點距離

但小子想講, 個班磚頭導師其實真係好L流.....10間? 小子識朋友今年都食左過億貨, 而仲係非常低調地食, 高調個班只係為左搵"學生" 呢個RISK FREE RETURN 而已, 好似R兄話齋, 食面口飯真係......免了

講番正題, 靠樓財自其實有3個階段:

1. 槓桿期

就係一個人的第一間樓, 相信無咩人唔靠槓桿可以FULL PAY 買. 而第一間樓, 絕對係, 多數係 (或者一定係) 靠槓桿, 例如呢家你買一間6M 樓下, 做80% 按揭 (或者4M樓下做90%按揭), 其實係做緊5倍/10倍槓桿

2. 播種期

當然, 成件事要成功, 先係在槓桿期買"啱"野, 可以係201X年開錯價的新樓, 可以係2012年的沙中綫/西環綫, (但唔包IMPERIAL KENNEDY), 又可以係2011-13年的市區單支/ 2014-15年的居屋狂潮...等等

好多人等個價升左之後, 翻按再推多一間, 咁就一生二宅 (又或者2011年前1開N, 不過小子此等80後就無咩可能享受到呢D咁筍的福利)

**其實小子認為一個家庭2間已經係正常人可以到達的極限

但講多幾句, 其實係HKMA 壓測下, 呢樣野已經唔可能, 因為MAX 只可以借一個人的100倍月薪左右, 而當你8皮野人工, 最多借8M 咁計, 基本上, 第二間樓已係不可能 (除非你老婆買, 咁叫做一人一間, 唔係一生二宅)

同埋播種期係好多人KICK住的時間, 因為一個人一生都好大機會買/賣唔到10間以上的物業, 所以買錯野 (例如泰國樓)的機會係大增, 如果你買左日本泰國樓明賺暗蝕輸滙水, 或者買左英國LONDON 跌左20%, 直接係對自己的財自路係會造成毁滅性的打擊 (或者買左D超高溢價的新樓/半新樓亦如是)

呢個STAGE亦都係大部份人停滯不前的時間;

財自, 除左要買啱野, 仲要買啱注碼

3. 收割期

王杰都有話, 我要知道幾時要退, 持盈保泰乃係重中之重, 死買爛買無限推, 一個浪打埋來便好似某D過氣大炒家咁, 2012/13年已話唔合理, 唔會高追, 結果進退失遽; 如果你係7老8十無所謂, 如果你係30幾, 就一生投資之路好似利記門將咁, 極大陰影面積下前行就無謂

因為DSD 同埋壓測關係, 基本上做到第二間已經收皮 (當然有知識有膽色係可以做到3,4,5,6間), 淨番下來就係減債, 而呢個可以有兩種形式

3a) 消極式

用人工及租金減債, 直到租金收入大於供樓支出

3b)主動式

係換貨為主, 將低YIELD的PORTFOLIO換成比較高YIELD的貨, 但係會GIVE UP 左升值潛力 (或者唔會,睇個人的操盤技術), 去蕪存菁, 搞掂後租金收入>供樓支出

# 當然, 一個叻人係唔會死買爛買, 一定係有幾台搵錢機器, 例如股/債/REITS/生意/主動收入等等去幫手加速減債, 但係單靠換貨得宜, 正常來講, 做到租金>供樓其實唔係一件遙不可及的事

不過相比起純債/REITS/ 股來講, 收入一定係有所不及, 因為債唔會升, REITS 理論上無樓升得咁多, GIVE UP 左個升值, 去買番個YIELD, 係合理TRADE OFF

今日柏蔚山開價, 小子係好痕好痕好L痕....一來, LEVERAGE RATIO 已係減到40% 樓下, 二來, 新世界呢幾年新作係有D質素, 小子係想整番間, 無奈2房15M (我估), 如果佢貼15% DSD 我可能會落疊, 不過呢口價真係...幾辣

姑且睇下佢開咩價

2018年5月26日 星期六

舊區尋寶記

今日同好朋友去港島區睇樓, 睇左3間, TARGET 約為6.5M 左右

一間320呎, 一間394呎, 一間377呎, 年齡由30年至50年不等

呎價由17200 - 20000/實呎不等

其實你俾得起錢, 基本上在港島區係買到野的, 仲要未講價, 如果業主肯讓步基本上600頭係有得揀

最衰小子無QUOTA, 又唔夠錢俾15% DSD, 如果唔係我真係會考慮再買多間

平, 一定唔算; 但貴, 就一定唔係

你睇下白石角嘉熙都16000/呎, 無雷公咁遠, 都係同價, 買呢件貨輸, 起碼我條氣順

來緊都會再睇下樓, 新舊都會睇, 一來UPDATE下個MARKET, 二來如果價錢OK, 真係可以考慮下

一間320呎, 一間394呎, 一間377呎, 年齡由30年至50年不等

呎價由17200 - 20000/實呎不等

其實你俾得起錢, 基本上在港島區係買到野的, 仲要未講價, 如果業主肯讓步基本上600頭係有得揀

最衰小子無QUOTA, 又唔夠錢俾15% DSD, 如果唔係我真係會考慮再買多間

平, 一定唔算; 但貴, 就一定唔係

你睇下白石角嘉熙都16000/呎, 無雷公咁遠, 都係同價, 買呢件貨輸, 起碼我條氣順

來緊都會再睇下樓, 新舊都會睇, 一來UPDATE下個MARKET, 二來如果價錢OK, 真係可以考慮下

2018年5月25日 星期五

近親轉讓正式收皮

尋日同老友食飯, 得知有一個律師朋友俾人CLAIM PROFESSIONAL INDEMNITY

因為個客玩近親轉讓, 以為俾SINGLE SD, 但係最尾IRD 出信話要俾番15% DSD

最後個律師要負責, 俾番個差額, 講緊無10M都有8M

DKLM, IRO 明明寫到明話OK, 但係最尾IRD 用S 61A 去REVOKE, 真係屈機

呢個更證明IRD 呢個措施係堅持同埋緊守住唔俾窮人慳稅狂買, 你有種FULL PAY玩公司轉讓 (印花稅0.1%, 免SSD, 任9你玩, 但係你有錢FULL PAY先算, 同埋公司盤叫到天咁高), 一係硬食15% (即係無左頭5年租金收入去俾條劏房波)

政府玩到咁串, 務求令到物業的交易成本大增, 令到一眾小市民想沽都唔得, 買更加唔得, 換樓? 你諗多左.

呢排好L多AA 係度煩住小子, 本來小子收到有OFFER 都可能考慮下沽間2房, 買多間3房, 但係如果再買/過底俾屋企人要俾15%的話, 那便加唔會考慮沽貨了

個個月坐係度咩都唔駛做算Q數.....

沽左拎番幾百萬買BONDS, 加息咪又係輸價贏COUPON, 買番又俾人罰15% 咁L ON9, 無啦啦轉來轉去屎忽痕多數無咩好結果

咩柒都唔沽啦,如果有抵的新樓食多間算啦,免煩

因為個客玩近親轉讓, 以為俾SINGLE SD, 但係最尾IRD 出信話要俾番15% DSD

最後個律師要負責, 俾番個差額, 講緊無10M都有8M

DKLM, IRO 明明寫到明話OK, 但係最尾IRD 用S 61A 去REVOKE, 真係屈機

呢個更證明IRD 呢個措施係堅持同埋緊守住唔俾窮人慳稅狂買, 你有種FULL PAY玩公司轉讓 (印花稅0.1%, 免SSD, 任9你玩, 但係你有錢FULL PAY先算, 同埋公司盤叫到天咁高), 一係硬食15% (即係無左頭5年租金收入去俾條劏房波)

政府玩到咁串, 務求令到物業的交易成本大增, 令到一眾小市民想沽都唔得, 買更加唔得, 換樓? 你諗多左.

呢排好L多AA 係度煩住小子, 本來小子收到有OFFER 都可能考慮下沽間2房, 買多間3房, 但係如果再買/過底俾屋企人要俾15%的話, 那便加唔會考慮沽貨了

個個月坐係度咩都唔駛做算Q數.....

沽左拎番幾百萬買BONDS, 加息咪又係輸價贏COUPON, 買番又俾人罰15% 咁L ON9, 無啦啦轉來轉去屎忽痕多數無咩好結果

咩柒都唔沽啦,如果有抵的新樓食多間算啦,免煩

2018年5月24日 星期四

梁振英:定罪年輕人中何以沒反對派子女?

【文匯網訊】(記者

莊恭誠)繼日前接連撰文反駁《蘋果日報》社論抹黑粵港澳大灣區發展,全國政協副主席梁振英昨日再度在網上刊文,提出近年沖廣場、「佔中」、暴動、造炸彈、潛逃、帶武器參加集會等一系列事件中,有一個問題最值得反思:「被捕被定罪被監禁的年輕人當中,為什麼沒有任何一個反對派頭面人物的子女?為什麼?為什麼一個也沒有?是誰不斷radicalise(激進化)和犧牲他人的子女?目的是什麼?用的是什麼手法?」

梁振英在文中又引述因涉及旺角暴亂案而被裁定暴動罪罪成的梁天琦、另一正在潛逃中的涉案人黃台仰之言,駁斥《蘋果日報》主筆盧峰在該報社評中稱,旺角暴亂「是民怨民憤長期累積的結果」云云。

戳穿《蘋果》謊言

梁天琦和黃台仰於暴亂發生後在網台節目中談及,香港出現的問題不應歸咎在梁振英身上。其中梁天琦更以2016年立法會選舉落敗人王維基失敗的「倒梁」經歷為例,直言反對派十分可笑,因為「到真正有政治利益瓜葛、衝擊,那些人的話可以完全改變。」

對於盧峰稱,中央視普選承諾為兒戲、候選人均為中央欽點云云,梁振英在文章中以事實回擊說,1990年通過的基本法,清楚規定普選行政長官的候選人由提名委員會提名,而非公民提名,「中央不接受『公民提名』,是違反承諾嗎?」

梁振英指出,無論循何種辦法選舉,中央都對行政長官具實質的任命權,因為香港特區行政長官的高度管治權,來自中央的額外授權。「『北京違反承諾』誤導了多少年輕人?年輕人信以為真,被推上火線,應該向誰問罪?」

雖然個人唔係太喜歡CY, 咩都玩對立面同埋賤格無比, 不過佢呢句真係值得深思, 點解呢? 點解做政治咁有前途唔推D仔女去做呢?

例如戴妖等人, 人地谷自己縮, 到有事呢家便將青年如棄草履係咩玩法?

敵我要分清, 班政棍多手持多國護照, 撈點油水便走人, 退休去也

但係你班有青攪串個PARTY, 又無外國護照, 係要你世世代代受番

梁振英在文中又引述因涉及旺角暴亂案而被裁定暴動罪罪成的梁天琦、另一正在潛逃中的涉案人黃台仰之言,駁斥《蘋果日報》主筆盧峰在該報社評中稱,旺角暴亂「是民怨民憤長期累積的結果」云云。

戳穿《蘋果》謊言

梁天琦和黃台仰於暴亂發生後在網台節目中談及,香港出現的問題不應歸咎在梁振英身上。其中梁天琦更以2016年立法會選舉落敗人王維基失敗的「倒梁」經歷為例,直言反對派十分可笑,因為「到真正有政治利益瓜葛、衝擊,那些人的話可以完全改變。」

對於盧峰稱,中央視普選承諾為兒戲、候選人均為中央欽點云云,梁振英在文章中以事實回擊說,1990年通過的基本法,清楚規定普選行政長官的候選人由提名委員會提名,而非公民提名,「中央不接受『公民提名』,是違反承諾嗎?」

梁振英指出,無論循何種辦法選舉,中央都對行政長官具實質的任命權,因為香港特區行政長官的高度管治權,來自中央的額外授權。「『北京違反承諾』誤導了多少年輕人?年輕人信以為真,被推上火線,應該向誰問罪?」

雖然個人唔係太喜歡CY, 咩都玩對立面同埋賤格無比, 不過佢呢句真係值得深思, 點解呢? 點解做政治咁有前途唔推D仔女去做呢?

例如戴妖等人, 人地谷自己縮, 到有事呢家便將青年如棄草履係咩玩法?

敵我要分清, 班政棍多手持多國護照, 撈點油水便走人, 退休去也

但係你班有青攪串個PARTY, 又無外國護照, 係要你世世代代受番

2018年5月23日 星期三

芬蘭學習

芬蘭學習, 呢篇真係無咩野可以打

香港人除左死操, 死操, 仲有死操

抺殺創意, 抺殺大膽創新, 抺殺面對失敗的勇氣

小朋友只懂玩一個有規則的遊戲, 而偏偏出去社會做事, 同一個事情係有N個解決方法, 對唔同人用唔用手法的效果會有著根本性, 本質性的結果分別

而由此種種, 香港小朋友都係由21歲大學畢業出來先開始學, 開始了解 (BY ELIMINATION) 自己唔鍾意做邊行, 而絕少了解自己"想做咩", "鍾意做咩", 更遑論 "擅長做咩"; 而世界的另一邊箱, 人家已由幼兒開始清楚自己鍾意咩,擅長咩, 同埋想要咩, 呢樣野已經領先香港青年20年......

在香港的RESULT DRIVEN 芬圍下, 做幾年SLASHER, 創業失敗買唔到樓, 彷彿對子女來講係世界末日, 對於父母來講更加係家門不幸, 年青人只好收斂自己的狂妄, 收起自己的理想, 加入樓奴行列, 人云亦云, 變成一個又一個沒有自我的人

小子回想起HKAL拎起成績單, 知道入MBBS 無望, 如果今天俾我做決定的話, 一定出國留學 (當然父母話無錢), 又或者, 重讀

如果以小子家庭環境, 應該負擔唔起出國, 而重讀或許係一條生路, 但俱往矣

點解教育學院係芬蘭人最想入的學系, 超越醫科同法律? 香港呢? GBUS? MBBS? LLB 有幾多係搵錢專業???

你睇下芬蘭的老師的社會地位? 我地香港又係咩人先讀IED (SORRY 小子年代係叫IED, 唔係教育大學)?

即便幾L有熱誠的老師, 都係要做怪獸家長的問責對象, 從來唔受尊重, 更不用說紅黃藍事件中國內大款對老師頤指氣使, 什至拳打腳踢

芬蘭乃創科強國, 今天呀楊焗長想搞好科技? 唔係起間科技大學就得, 真係要在學習上做出翻天覆地, 根本性, 結構性的改革

否則10年, 20年, 100年後, 好彩的話, 都仲係一個國際金融大賭場; 唔好彩的話, 只係一個廣東省深圳市下面的渡假小漁村

香港人除左死操, 死操, 仲有死操

抺殺創意, 抺殺大膽創新, 抺殺面對失敗的勇氣

小朋友只懂玩一個有規則的遊戲, 而偏偏出去社會做事, 同一個事情係有N個解決方法, 對唔同人用唔用手法的效果會有著根本性, 本質性的結果分別

而由此種種, 香港小朋友都係由21歲大學畢業出來先開始學, 開始了解 (BY ELIMINATION) 自己唔鍾意做邊行, 而絕少了解自己"想做咩", "鍾意做咩", 更遑論 "擅長做咩"; 而世界的另一邊箱, 人家已由幼兒開始清楚自己鍾意咩,擅長咩, 同埋想要咩, 呢樣野已經領先香港青年20年......

在香港的RESULT DRIVEN 芬圍下, 做幾年SLASHER, 創業失敗買唔到樓, 彷彿對子女來講係世界末日, 對於父母來講更加係家門不幸, 年青人只好收斂自己的狂妄, 收起自己的理想, 加入樓奴行列, 人云亦云, 變成一個又一個沒有自我的人

小子回想起HKAL拎起成績單, 知道入MBBS 無望, 如果今天俾我做決定的話, 一定出國留學 (當然父母話無錢), 又或者, 重讀

如果以小子家庭環境, 應該負擔唔起出國, 而重讀或許係一條生路, 但俱往矣

點解教育學院係芬蘭人最想入的學系, 超越醫科同法律? 香港呢? GBUS? MBBS? LLB 有幾多係搵錢專業???

你睇下芬蘭的老師的社會地位? 我地香港又係咩人先讀IED (SORRY 小子年代係叫IED, 唔係教育大學)?

即便幾L有熱誠的老師, 都係要做怪獸家長的問責對象, 從來唔受尊重, 更不用說紅黃藍事件中國內大款對老師頤指氣使, 什至拳打腳踢

芬蘭乃創科強國, 今天呀楊焗長想搞好科技? 唔係起間科技大學就得, 真係要在學習上做出翻天覆地, 根本性, 結構性的改革

否則10年, 20年, 100年後, 好彩的話, 都仲係一個國際金融大賭場; 唔好彩的話, 只係一個廣東省深圳市下面的渡假小漁村